Hello everyone, dear FounderN readers, in this blog post we are talking abot the financial literacy. I think this topic is that everyone should know because financial literacy is the most used subjects in the bussiness life. If you wish, let’s start, enjoy reading!

What is and what is not?

These small skills that can be a part of our daily lives, such as money management, debt management, saving, investing and reaching financial goals, all come together under Financial Literacy , along with the ability to make financial decisions . Sometimes it is based on building a secure future with short-term and sometimes long-term financial investments.

Let’s Take a Brief Look at the Key Components of Financial Literacy!

Money Management and Budgeting in Financial Literacy

Create Budget Categories: Let’s classify our expenses to see how much we will save in which area. Let’s be careful to control our expenses especially soberly, the comparison between the previous and next month gives us the deviation rate.

Determine Your Income-Expense Account : List your active and passive income sources that bring you money. Then calculate your expenses and cover them with your income. Make sure that your expenses are not more than your income. This is a good first step to see if there is a mistake.

What is an Emergency Fund?

It is a savings that covers 3-6 months of living expenses for unexpected expenses. It allows you to avoid debt and it is quite logical to save over time with regular small payments.

Some Strategies for Financial Literacy

Financial literacy helps you make good decisions to achieve your goals through money management and investing. Here are some basic strategies to develop these skills.

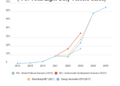

The Early Bird Catches the Worm: It is very important to start early to reach your financial goals. By taking early steps to both add savings to your budget and start investing, you can ensure that your savings grow over time. Early investments and savings create significant savings with the effect of compound interest. You can follow the page of RWA Inc., a company that I also reported on, to follow the market.

Who Lost by Trying Different Things: Diversifying both your budget and your investments reduces your financial risks. By dividing your budget into different categories (essential expenses, savings, entertainment, etc.), you can achieve balance in all areas and prevent overspending. Similarly, by diversifying your investments, it may make sense to balance the loss of one investment with the gains you make from others.

Click for another our blog post! A New Generation Breath in Software: What is Visual Studio Code and How to Use It?

About The FounderN!

FounderN is a dynamic digital media platform operating with the latest news of the entrepreneurship world, innovation-focused content and works that add value to every part of the ecosystem. Our adventure, which started in 2020 under the name of “Girisim Haberleri”, continues it is journey to become the inspiring dynamic voice of the entrepreneurship ecosystem with the FounderN identity as of September 2024. FounderN brings together business leaders, investors and entrepreneurs with you by presenting developments in the world of technology, entrepreneurship and investment with a creative and innovative perspective.

As FounderN, our mission is not only to share the latest developments, but also to make our readers an active part of these developments and to contribute to the sustainable growth of the ecosystem. If you want to be informed about the latest developments in the ecosystem and be a part of this growing community, you can subscribe to our newsletter, follow us on our social media accounts and join this inspiring journey. Have a luck day.

Continue Discovering with Us: Click for other #CurrentNews that may interest you!

You can access FounderN Turkey’s Instagram account here.

You can access FounderN Global’s Instagram account here.

Comments 1