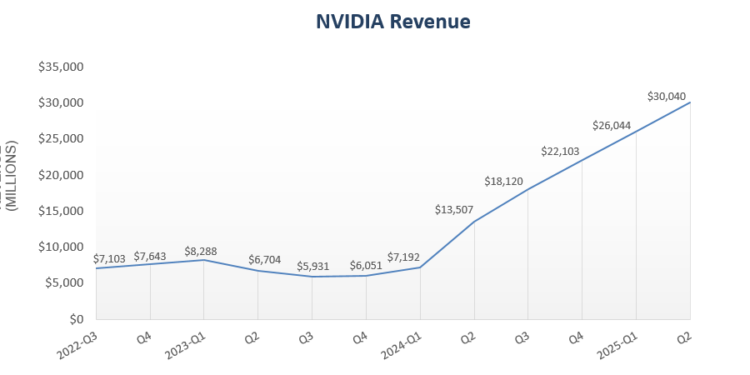

In a striking revelation from Nvidia’s recent SEC filing, it was disclosed that two mystery customers accounted for a staggering 39% of the company’s Q2 revenue. This highlights the customer concentration risk inherent in Nvidia’s revenue model, as the chipmaker celebrated a remarkable $46.7 billion in revenue for the quarter, marking a 56% year-over-year surge primarily fueled by the booming AI chip market and robust demand in data centers. Specifically, one major customer contributed 23% of total Q2 revenue, while another followed closely with 16%. The spotlight on these customers raises questions about the sustainability of Nvidia’s growth, especially as it heavily relies on large cloud service providers who collectively accounted for a significant portion of its data center revenue. Despite this risk, industry analysts remain optimistic about Nvidia’s future, citing the lucrative spending trends anticipated from these high-cash-flow customers over the coming years.

Recent insights into Nvidia’s financial performance reveal that a select few clients play a pivotal role in driving revenue. With two unnamed parties contributing nearly 40% to the company’s second-quarter earnings, concerns regarding revenue dependency have emerged. The report underscores the significance of major players in the AI semiconductor sector and their profound impact on overall sales figures. Additionally, the substantial contributions from large-scale cloud computing providers further accentuate the dynamic landscape of the AI chip industry. As Nvidia navigates the delicate balance of fostering diverse customer relationships while capitalizing on the current demand surge, understanding this evolving marketplace becomes vital.

Understanding Nvidia’s Q2 Revenue Breakdown

Nvidia’s latest revenue report reveals a striking concentration of sales among just a couple of key customers, highlighting a crucial aspect of the company’s financial landscape. In Q2, a staggering 39% of Nvidia’s revenue was generated from only two clients, referred to in filings as ‘Customer A’ and ‘Customer B.’ This phenomenon underscores the importance of understanding customer concentration risk, as being overly dependent on a limited number of buyers can pose challenges for future growth. Nonetheless, the company reported an exceptional total revenue of $46.7 billion, largely fueled by the burgeoning demand for AI technologies fueled by its cutting-edge data center solutions.

This dependency on a select group of customers outlines the complexities within Nvidia’s business model. While it has thrived under the demands placed by the AI chip market, particularly for cloud services, the reliance on just two clients for such a substantial portion of revenue raises concerns about sustainability. If these customers were to diversify their suppliers or reduce spending, Nvidia could experience significant revenue fluctuations, potentially affecting its overall market stability and growth trajectory.

Customer Concentration Risk in Nvidia’s Business Model

The concentration of revenue from a handful of customers, as seen in Nvidia’s quarterly report, is a classic case of customer concentration risk. As Nvidia continues to excel in the AI chip market, it relies heavily on a few large clients whose purchasing behaviors can significantly impact the company’s revenue streams. Particularly alarming is the assertion that Customer A and Customer B alone accounted for nearly 39% of the revenue during this quarter. Such a model can create vulnerabilities, especially in an industry as volatile as technology, where shifts in demand can happen rapidly.

However, it’s essential to balance this risk against the financial stability of the major players involved. These high-revenue customers, often large cloud service providers, have robust financial backing, which mitigates the risk of sudden financial downturns. These organizations not only contribute 50% of Nvidia’s data center revenue but are also expected to sustain heavy investments in advanced technologies. As Nvidia braces for future challenges, understanding the dynamics between large customers in the AI ecosystem will be vital.

The Role of Cloud Service Providers in Nvidia’s Revenue Growth

Cloud service providers play a crucial role in the trajectory of Nvidia’s revenue growth, contributing significantly to its data center revenue. In fact, Nvidia’s Chief Financial Officer noted that large cloud service providers account for half of its data center income, which represents a substantial component of the company’s overall earnings. With a thriving cloud market, these service providers have been investing heavily in AI capabilities, thereby driving demand for Nvidia’s GPUs and AI chips at an unprecedented scale.

This transformation within the cloud sector bodes well for Nvidia as technology firms increasingly rely on AI for efficiency and innovation. The collaboration between Nvidia and these cloud giants has positioned the company as a leading provider in the AI chip market. Despite the potential risks tied to customer concentration, the expected spending growth from these major entities in the coming years could provide a buffer against market fluctuations and fortify Nvidia’s position as a key player in enabling the future of AI.

The Impact of AI Data Center Demand on Nvidia’s Future

The explosion of demand for AI and machine learning capabilities has significantly impacted Nvidia’s future, reflected in its data center revenue surge. The company’s latest report shows that AI and data center solutions account for the lion’s share of overall revenue, signaling a fundamental shift in technological investment preferences. Many experts believe that as industries pivot toward AI-driven strategies, Nvidia will continue to be at the forefront, providing the necessary hardware for innovation and scalability.

This stark increase in revenue from data centers is not merely a trend but a transformative wave in technology, presenting Nvidia with opportunities to diversify its product lines and customer base. With major cloud service providers expected to ramp up their spending on data centers and AI technologies, Nvidia’s potential for future growth seems promising. This scenario allows for a proactive approach to mitigate customer concentration risks by expanding its footprint across multiple sectors and reducing dependency on a select few clients.

Analyzing Nvidia’s Competitive Advantage in the AI Chip Market

Nvidia’s positioning within the AI chip market provides a significant competitive advantage, accelerated by the company’s advanced processing capabilities and innovative chip designs. The AI sector’s fast-paced evolution creates a landscape where companies that can deliver top-tier performance and efficiency, like Nvidia, stand out. This competitive edge allows Nvidia to not only capture a sizable market share but also to establish long-lasting partnerships with major technology companies and cloud service providers.

As competition intensifies in the AI chip market, maintaining this advantage will require continuous investment in research and development. With the rise of various competitors, such as AMD and Intel, Nvidia must innovate and adapt to evolving technological demands quickly. The practice of building relationships with large clients, while also broadening its offerings to various industry segments, could prove essential for Nvidia in solidifying its dominance in the market.

Forecasting Nvidia’s Revenue Trends Amid Market Changes

As the technology landscape shifts, Nvidia’s revenue forecast suggests optimism tempered by caution regarding customer concentration. The company must navigate through potential market fluctuations, particularly given the revelation that two customers comprise significant portions of total revenue. Analysts warn that any adverse changes in these customers’ strategy could lead to sweeping impacts on Nvidia’s earnings, complicating revenue predictions in an increasingly competitive market.

However, trends in AI expansion and the continued demand from cloud service providers indicate growth opportunities. By assessing these projections, Nvidia can strategically prepare for fluctuations while aiming to broaden its customer base. The evolution of its business model, pivoting towards diversified sectors and venturing into new markets will be crucial for keeping revenue streams stable, thereby ensuring long-term success amid market volatility.

Future Prospects for Nvidia in an Evolving Tech Landscape

Looking ahead, Nvidia faces an evolving tech landscape with considerable opportunities and inherent risks. As AI adoption accelerates across various sectors—from healthcare to automotive—Nvidia’s core offerings align well with market needs. The company’s potential for innovation, driven by advancing AI capabilities, positions it favorably to capitalize on growing applications that demand sophisticated hardware.

However, the focus on just a few key customers remains a topic of concern. Analyst perspectives suggest that while these clients may possess the financial resources to invest continuously in AI infrastructure, Nvidia must work on expanding its clientele to mitigate risks. As the tech landscape changes, a proactive approach towards diversification and innovation will be vital in solidifying Nvidia’s status as a leader in the AI chip market.

Navigating Financial Risks Associated with Major Clients

Managing financial risks associated with customer concentration will be a priority for Nvidia as it navigates its business strategies in the forthcoming years. The revealed dependency on ‘Customer A’ and ‘Customer B’ for a significant portion of revenue necessitates a strategic assessment of client profiles and market dynamics. Concentration risk can lead to vulnerabilities, especially during economic downturns or shifts in client priorities in the tech sector, where agility and diversification are crucial.

Strategically, Nvidia may consider enhancing its service offerings and pursuing partnerships with a more diverse array of clients to counterbalance these risks. By proactively engaging with smaller market players and exploring emerging sectors, Nvidia can cultivate a broader revenue base while maintaining its leading technological edge. This focus on diversification could serve as a buffer against market volatility, ultimately supporting Nvidia’s sustained success.

Concluding Thoughts on Nvidia’s Market Dynamics and Future

In summary, Nvidia’s revenue report sheds light on both the triumphs and challenges of its current market position, driven by significant AI and data center demand. While the company has recorded remarkable financial milestones, the heavy reliance on a few customers for substantial revenue raises questions about future stability. Balancing the growth potential with customer concentration risk will require thoughtful strategic planning.

As the AI chip market continues to expand, propelled by advancements in technology and increased investment from major players, Nvidia is well-poised to leverage its competitive advantages. However, success in the future will depend on its ability to not only innovate but also expand its client base, thereby ensuring a diverse revenue model that can withstand fluctuations and fortify its market leadership.

Frequently Asked Questions

What percentage of Nvidia’s Q2 revenue was generated from its top customers?

In Nvidia’s Q2 revenue report, it was revealed that nearly 40% of the total revenue came from just two customers, referred to as Customer A and Customer B. Specifically, one customer accounted for 23% and the other for 16% of the Q2 revenue.

Who are the main contributors to Nvidia’s Q2 revenue growth?

Nvidia’s Q2 revenue growth was largely driven by the AI chip market, particularly fueled by demand from large cloud service providers. These providers accounted for approximately 50% of Nvidia’s data center revenue, which represented a significant portion of the company’s overall earnings.

What risks does Nvidia face due to customer concentration in its Q2 revenue?

Nvidia’s reliance on a small number of customers, notably two that contributed 39% of Q2 revenue, presents a customer concentration risk. This means that fluctuations in spending or changes in business from these key customers could significantly impact Nvidia’s financial performance and revenue stability.

How did Nvidia’s data center revenue impact its overall earnings in Q2?

Nvidia reported that data center revenue was a major contributor to its overall earnings, making up 88% of total revenue for Q2. The surge in demand for AI technologies from large cloud service providers is a significant factor in this growth.

What is Nvidia’s strategy moving forward regarding its customer base?

Going forward, Nvidia is likely to focus on diversifying its customer base to mitigate the risks associated with customer concentration. While its current major customers have strong financial capacity and are expected to continue spending heavily on data centers, expanding its customer network will provide additional security against potential revenue losses.

How has the AI chip market influenced Nvidia’s Q2 financial results?

The AI chip market has played a crucial role in Nvidia’s financial success for Q2, contributing to a record revenue of $46.7 billion, marking a 56% year-over-year increase. The rapid growth in AI-related applications has led to heightened demand from key customers in the data center sector.

What classifications does Nvidia use to categorize its customers?

In its filings, Nvidia classifies its customers primarily as direct customers, which include original equipment manufacturers (OEMs), system integrators, and distributors. Indirect customers, like cloud service providers, acquire Nvidia products through these direct channels.

What should investors understand about Nvidia’s revenue sources from Q2?

Investors should note that while Nvidia’s Q2 revenue reported strong growth, it is significantly tied to a few major customers. Understanding this concentration risk, along with the steady financing capabilities of these customers and their expected future spending on data centers, is essential for evaluating Nvidia’s long-term prospects.

| Key Point | Details |

|---|---|

| Revenue Concentration | Two customers accounted for 39% of Nvidia’s Q2 revenue. |

| Single Customer Impact | One customer represented 23% of total Q2 revenue, and another 16%. |

| Overall Revenue Growth | Nvidia reported record revenue of $46.7 billion, a 56% year-over-year increase. |

| Customer Composition | Customer A and Customer B have been significant in the first half of fiscal 2025. |

| Revenue Risk | Revenue concentration poses a risk, but these customers are financially strong. |

| Indirect Customers | Cloud service providers may be indirectly linked to sales figures. |

| Future Prospects | Large cloud service providers accounted for 50% of data center revenue. |

Summary

Nvidia Q2 revenue customers were pivotal in driving nearly 40% of the company’s total revenue, highlighting the significant concentration of earnings from a small group of clients. The financial dependence on two main customers raises concerns about revenue stability, yet these customers are likely to continue investing heavily in AI infrastructure, ensuring robust future earnings for Nvidia. Overall, while the current revenue model poses risks, the financial strength of these key customers could support sustained growth in Nvidia’s overall performance.

Introducing Autowp, the ultimate solution for WordPress users seeking an innovative AI content generator and AI content creator plugin! With Autowp, you can effortlessly craft high-quality, engaging content that resonates with your audience, helping to boost your website’s SEO and drive traffic. Create original articles, blog posts, and more in mere minutes, all while harnessing the power of advanced artificial intelligence. Experience the future of content creation with Autowp today! To remove this promotional paragraph, upgrade to Autowp Premium membership.